As inflation continues to affect household budgets across the United States, the Alaska Permanent Fund Dividend (PFD) has once again drawn national attention — not only as a unique state program but as one of the few ongoing direct payments to citizens in 2025. This year’s PFD payment of $1,702 per eligible Alaskan has become a major talking point, sparking widespread interest and confusion online, especially after headlines labeled it a “stimulus payment.”

While it’s not technically a federal stimulus, the PFD operates in a similar way: providing direct financial support to residents. The 2025 payment includes a standard dividend of $1,403.83 and a one-time bonus of $298.17, together making up the total $1,702 payout. Payments started in late September 2025 and will continue through November 2025, depending on application and verification status.

This comprehensive article breaks down the eligibility criteria, payment calendar, reasons for the payout, tax responsibilities, and how to ensure you receive it without delay.

Understanding the Alaska Permanent Fund Dividend

The Alaska Permanent Fund Dividend, often abbreviated as PFD, is one of the most remarkable examples of how a state shares its natural wealth with its people. The fund was established in 1976 after the discovery of oil at Prudhoe Bay. Lawmakers wanted to make sure that future generations would benefit from Alaska’s petroleum revenue, even after oil production declines.

The fund is managed by the Alaska Permanent Fund Corporation (APFC), which invests a portion of the state’s oil royalties into a diversified portfolio of stocks, real estate, bonds, and private equity.

Every year, a portion of the fund’s earnings — specifically around 5% of its total value — is distributed among eligible Alaskan residents in the form of dividends.

The dividend amount varies yearly depending on investment returns, inflation, and the fund’s long-term performance, but the 2025 figure of $1,702 represents one of the most stable and generous payouts in recent years.

Why People Are Calling It a “Stimulus Payment”

Many residents outside Alaska have misinterpreted the PFD as a nationwide stimulus check, largely because of its timing and format. Like the pandemic-era stimulus checks, the PFD is deposited directly into residents’ bank accounts and offers unrestricted spending freedom.

However, it’s important to clarify that:

- The $1,702 payment is only for eligible Alaska residents, not for all U.S. citizens.

- It is funded entirely by Alaska’s oil revenue, not federal government stimulus funds.

- It is a recurring state program, not a one-time relief measure.

Still, for Alaskans, the PFD effectively functions as a yearly financial boost, helping offset the state’s high cost of living, remote lifestyle expenses, and inflation pressures.

Payment Breakdown for 2025

The total amount for 2025 has been set at $1,702 per eligible recipient. This figure is divided into two parts:

| Component | Amount (USD) | Purpose |

|---|---|---|

| Standard PFD Dividend | $1,403.83 | Regular annual distribution from fund earnings |

| One-time Bonus Payment | $298.17 | Additional bonus approved due to surplus investment returns |

| Total 2025 Payment | $1,702.00 | Total benefit per eligible Alaskan |

The bonus payment was introduced following higher-than-expected investment gains in the previous fiscal year, as well as the fund’s strong recovery after market fluctuations in 2023–2024.

Eligibility Criteria

To receive the 2025 Alaska PFD, residents must meet a strict set of requirements. These criteria ensure that only permanent and law-abiding Alaskan residents benefit from the state’s natural resource revenues.

Eligibility Requirements Include:

- Residency: The applicant must have been a resident of Alaska for the entire calendar year 2024 and must intend to remain a resident indefinitely.

- Absence Limit: Applicants cannot be absent from the state for more than 180 days in the qualifying year, except for acceptable reasons such as:

- Military service

- Full-time education

- Medical treatment

- Accompanying a dependent or spouse for similar reasons

- Criminal Record: Applicants convicted of a felony or certain misdemeanors during 2024 are not eligible for the 2025 payment.

- Application Window: Applications were open from February 1 to April 30, 2025. Late submissions are not accepted under any circumstances.

- Residency Verification: Proof of residence such as utility bills, lease agreements, or state ID must be provided during the application process.

These rules ensure the fairness and sustainability of the PFD program, preventing misuse and ensuring that genuine residents receive the benefit.

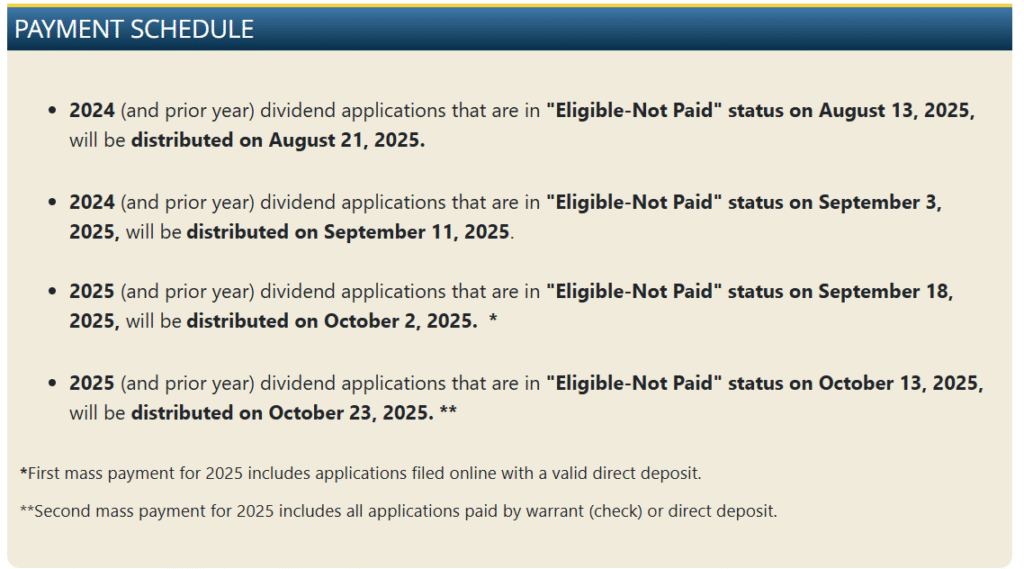

2025 PFD Payment Schedule

The PFD Division releases payments in phases based on verification, eligibility status, and corrections for prior-year delays. While initial disbursements began in late September, some recipients will continue receiving funds through November 2025.

| Resident/Application Status | Payment Date | Remarks |

|---|---|---|

| Applicants with 2024 backlogs cleared | September 30, 2025 | Payment for delayed previous cycles |

| Verified applicants as of September 18, 2025 | October 2, 2025 | Early batch release |

| “Eligible – Unpaid” status as of October 13, 2025 | October 26, 2025 | Main October distribution |

| Late verification or address corrections | November 12–30, 2025 | Final processing and direct deposits |

All payments are processed via direct deposit to the applicant’s registered bank account on the myAlaska platform. Paper checks are issued only in rare cases where direct deposit details are unavailable or invalid.

How to Apply for Future PFD Payments

While the 2025 window has closed, Alaskans can prepare for the next cycle. The 2026 application period will open on February 1, 2026, and close on April 30, 2026.

Steps to Apply Online:

- Visit pfd.alaska.gov and log in using your myAlaska credentials.

- Complete the online application form with your personal, contact, and residency details.

- Attach scanned documents for proof of residency.

- Enter accurate bank details for direct deposit.

- Review your form carefully and submit before the deadline.

Applicants can also file paper applications at local PFD offices, but online submissions are faster and easier to track.

Common Mistakes to Avoid

Thousands of Alaskans face delays or denials each year because of simple application errors. To ensure timely payment, avoid the following common mistakes:

- Submitting after the April 30 deadline

- Entering incorrect bank details or mailing addresses

- Failing to disclose extended absences from Alaska

- Providing incomplete or incorrect proof of residency

- Neglecting to review all application information before submission

Keeping your myAlaska profile updated is essential. Outdated contact or banking details are among the top reasons for delayed payments each year.

Updating Address and Banking Information

If you’ve moved or changed banks since applying, you must update your information immediately at pfd.alaska.gov.

Incorrect details can lead to:

- Delayed payments

- Returned deposits

- Lost or misdirected checks

You can update these details anytime through your myAlaska account under the “Change Information” tab.

Economic Impact of the $1,702 Payout

The PFD may seem like a simple annual dividend, but its economic impact is enormous for a small population like Alaska’s. With around 650,000 eligible residents, the total distributed amount in 2025 will exceed $1.1 billion.

Economic Contribution Estimate (2025)

| Category | Estimated Impact |

|---|---|

| Total distributed funds | ~$1.1 billion |

| Average household benefit (3 members) | ~$5,106 |

| Estimated retail spending boost | +3.2% during Q4 2025 |

| Temporary job creation in local sectors | ~1,500 seasonal positions |

For many families, the PFD serves as a financial cushion before the winter months, helping pay for fuel, groceries, and home maintenance costs. Economists also note that it stimulates local economies, especially in remote communities where transportation and food costs are significantly higher.

Tax Implications

The State of Alaska does not tax the PFD, but the IRS treats it as taxable income. Recipients must include the PFD amount when filing their federal income tax returns for 2025.

To simplify filing, the Alaska Department of Revenue issues Form 1099-MISC early in 2026. Taxpayers can choose to have a small portion withheld for federal taxes at the time of payment or handle it during annual filing.

Those receiving multiple years of back payments in 2025 should report each year’s amount separately to avoid discrepancies with the IRS.

Missed the 2025 Deadline? Here’s What to Do

If you missed the April 30, 2025 deadline, unfortunately, your application cannot be processed for the current year. The PFD program does not allow late applications under any circumstances.

However, you can:

- Prepare early for the 2026 cycle by gathering documents in January.

- Ensure your myAlaska account is active and linked to your verified ID.

- Sign up for email or SMS notifications from the PFD Division to stay informed about application openings.

Historical Trends in Alaska PFD Payments

The dividend fluctuates each year depending on fund performance and legislative adjustments.

| Year | Total Dividend (USD) | Notes |

|---|---|---|

| 2022 | $3,284 | Included a special energy relief payment |

| 2023 | $1,312 | Reduced due to budget adjustments |

| 2024 | $1,561 | Stable recovery following market rebound |

| 2025 | $1,702 | Standard + bonus structure implemented |

Over time, the fund has continued to grow, now valued at over $80 billion in 2025, ensuring long-term sustainability for future payouts.

Broader Significance of the PFD

Beyond individual benefits, the PFD symbolizes Alaska’s commitment to resource equity and public ownership. It transforms oil wealth into a shared public good, setting a global example for how natural resource revenue can promote social welfare.

It also reinforces Alaska’s unique social contract — recognizing that every resident, by living in and contributing to the state, has a right to share in its wealth.

The PFD has become a cornerstone of Alaskan identity, celebrated each year as both an economic event and a point of community pride.

Real-Life Impact: How Alaskans Use the Dividend

For many families, the PFD provides the flexibility to manage expenses, invest, or save for the future. Some of the most common uses include:

- Energy bills and heating fuel during winter months

- Groceries and household supplies

- Travel costs for visiting family or medical appointments

- Savings and investments for children’s education

- Charitable donations, as many Alaskans choose to “Pick. Click. Give.” during application

Even though it’s a modest amount compared to annual income, for rural and remote Alaskans, the dividend can mean the difference between stability and hardship.

How to Check Your Payment Status

Applicants can track their PFD status by logging into myAlaska and selecting “Permanent Fund Dividend.” The system displays one of the following statuses:

| Status | Meaning |

|---|---|

| Eligible – Paid | Payment successfully deposited |

| Eligible – Unpaid | Payment approved, awaiting processing |

| In Review | Documents under verification |

| Denied | Application did not meet eligibility criteria |

If your status remains “Eligible – Unpaid” after November 30, 2025, you should contact the PFD Division’s support center to verify banking details.

Tips for Smooth Processing in Future Cycles

- Apply Early: Submitting your application in February ensures early verification.

- Keep Records: Maintain digital copies of your documents and submission receipts.

- Stay Updated: Subscribe to PFD email alerts for changes or policy updates.

- Avoid Fraud: Only apply through the official government site — pfd.alaska.gov.

- Verify Banking Details: Always double-check your account and routing numbers.

The Bigger Picture: Alaska’s Oil Wealth and Citizen Benefits

The Alaska PFD stands as a model of wealth redistribution that many economists and policymakers around the world admire. It reflects the principle that natural resources belong to all citizens, and that their value should be shared fairly rather than concentrated in private hands.

Since its inception, the program has distributed more than $50 billion in dividends, creating an enduring legacy that supports generations of Alaskans.

The fund’s disciplined investment strategy — focusing on sustainable returns rather than short-term profit — ensures that the PFD can continue even when oil prices fluctuate or production slows.

Conclusion

The $1,702 Alaska Permanent Fund Dividend for 2025 is not just another financial boost — it’s a symbol of community wealth, responsibility, and equality. As payments continue through November 2025, eligible residents are reminded to keep their accounts updated and ensure their tax obligations are met.

For many, this dividend arrives as a timely relief amid rising living costs, helping families prepare for the harsh winter ahead. For Alaska as a whole, it represents the enduring power of a state that believes in sharing prosperity directly with its people.

The Alaska PFD remains a living example of what’s possible when natural wealth is treated as a public trust — not a private gain.

FAQs

Who qualifies for the $1,702 payment?

Only Alaska residents who meet the 2025 PFD eligibility requirements and applied between February 1 and April 30, 2025.

When will payments be completed?

Final payments are expected to be deposited by November 30, 2025, depending on verification status.

Is the payment taxable?

Yes, the IRS considers it taxable income, though Alaska itself does not tax it.

How can I check my payment status?

Log in to your myAlaska account and check the “Permanent Fund Dividend” section for real-time updates.

What happens if I missed the application deadline?

You must wait until February 2026 to apply for the next year’s dividend.

Leave a Comment